Customer Relations

Zillow operates the leading real estate and home-related information marketplaces on mobile and the web (investors.zillow.com, 2017). The company's primary customers are real estate, mortgage, and rental professionals and brand advertisers (investors.zillow.com, 2017). These professionals contribute to the company's primary revenue from the sale of advertising under the Premier Agent and Premier Broker Programs (investors.zillow.com, 2017). These programs offer a suite of marketing and business technology products and services to help them achieve their advertising needs (investors.zillow.com, 2017).

The company has built a trusted and transparent marketplace where consumers can search and read reviews on the local real estate, rental, and mortgage professionals and contact those professionals on their terms (investors.zillow.com, 2017). According to Levy (2018), the company got an average of 151 million monthly unique visitors to its various website and apps setting a record of web traffic with 187 million unique visitors in the fourth quarter of 2017. The home-related marketplace that the company has built benefit from network effects (investors.zillow.com, 2017). As more consumers visit the website and use the mobile applications to use the company's product and services, the more real estate, rental, and mortgage professionals contribute content to distinguish themselves, thereby making the marketplace more useful and attracting additional consumers (investors.zillow.com, 2017).

According to DiPietro (2017), the company will employ the following methods to grow its audience and increase user engagement:

Enhance existing products and develop new offerings (DiPietro, 2017).

Enhance database of homes and create new consumer tools (DiPietro, 2017).

Launch more applications to extend Zillow's brand across additional mobile platforms (DiPietro, 2017).

Create new opportunities for consumers to reach real estate, rental, and mortgage professionals (DiPietro, 2017).

Increase brand awareness through targeted advertising programs, public, relations, and social media (DiPietro, 2017).

DiPietro (2017) added that Zillow's Premier Agent revenue accounted for 71% of the company's total revenue. The company has a plan to increase that number in a variety of ways:

Increase audience size and engagement to bring in more agents (DiPietro, 2017).

Entice agents to spend more with Zillow on advertising by enhancing analytics to show them the returns on their advertising investments and allow them to self-service their advertising needs by giving them tools to advertise on Zillow's various sites by placing ad buys online (DiPietro, 2017).

Fine tune the dynamic self-service pricing model for each zip code (DiPietro, 2017).

Create new products to help agents build their personal brands within the local markets they serve (DiPietro, 2017).

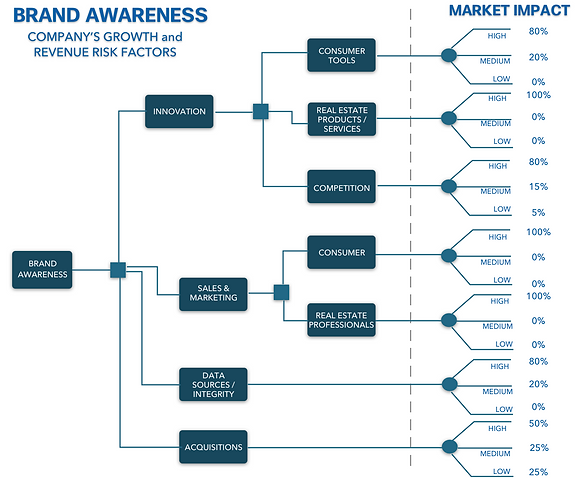

The company views the strength of brand awareness and loyalty from their consumers and business facing brands as a key differentiator (investors.zillow.com, 2017). Brand awareness and reputation come from the quality of the consumer experience, the utility of the data and free services provided in their app and web platform, and the breadth and depth and accuracy of information (investors.zillow.com, 2017). Figure 13 illustrates the company's growth and revenue risk factors if brand awareness declines. There are four significant risk factors that could affect the company's growth and revenue -innovation, new products, and services, data sources/integrity and acquisitions.

The company invests significant resources in research in development to continue to innovate new and improve existing products and services in their mobile, web platform and other tools useful for consumers, real estate, rental, and mortgage professionals. These innovations continue to attract consumers and advertisers attributing to the growth of the company. In consumer tools, it is a "high" market impact if the company does not continue to offer high-quality, innovative products and services. Attracting consumers is the lifeblood of the company's advertising business. Innovation in real-estate products and services also has a "high" market impact in the company's business as the Premier Agent, and Premier Broker program accounted for 71% of the company's total revenue (investors.zillow.com, 2017). A decline in subscription and advertising spend from real estate professionals could negatively impact the company's revenue.

When it comes to competition, the company has to out-innovate the competition. According to Graham (2017), Zillow is out-innovating its competitors in augmenting the basic listing data with other data including listings of homes not for sale and by investing heavily in mobile. Furthermore, the company also continues to invest significant resources in developing, testing and launching new products and service to address the needs of the market and improve the home buying, selling, financing, building and renting experience (investors.zillow.com, 2017). Another major factor that could harm the company's brand and financial condition is the data source integrity used in the company's products and services. Consumers will stop using the company's real estate marketplace if the data integrity suffers real or perceived harm. Lastly, acquisitions could pose risks and other problems if the company fails to realize its benefits which could incur unanticipated liabilities and harm the company's revenue (investors.zillow.com, 2017).

Figure 13: Brand Awareness. Growth and Revenue Risks

UTILITY FUNCTION ANALYSIS

According to Dutta (2017), a Utility function is an important component of microeconomics. Economists use the utility function to derive a relationship between the money possessed by an individual and the value derived in purchasing different goods and services (Dutta, 2017). Figure 14 illustrates the company's cost of innovation and sales and marketing spend with the risk associated with it. It represents the value of the dollars spent versus their revenue and growth. The values in the chart are an estimate from the company's 2017 Earnings Report. Current Innovation costs were $470 million, and Sales and Marketing were $533 million. The analysis showed that the expected utility of sales and marketing at .70 has more value than the innovation cost at .6375. This result reflects the current dollar budget or ratio in the company's balance sheet. Figure 15 is the estimated utility value per dollar spent.

Figure 14: Utility Function Analysis

Figure 15: Utility Values

Figure 16: Utility Function